is colorado a community property state for tax purposes

Property tax is one of the major sources of local tax revenue in Colorado and is primarily administered by county assessors. Colorado is an equitable distribution or common law state rather than a community property state.

State Taxation As It Applies To 1031 Exchanges

Colorado is not a community property state but it does have a category called marital property in colorado most assets acquired during a marriage are considered marital property which is subject to division by the courts in a divorce.

. Colorado is a common law state not a community property state which means that each spouse is a separate individual with separate legal and property rights. Nonresidential property values decreased by 16. Colorado is an equitable distribution or common law state rather than a community property.

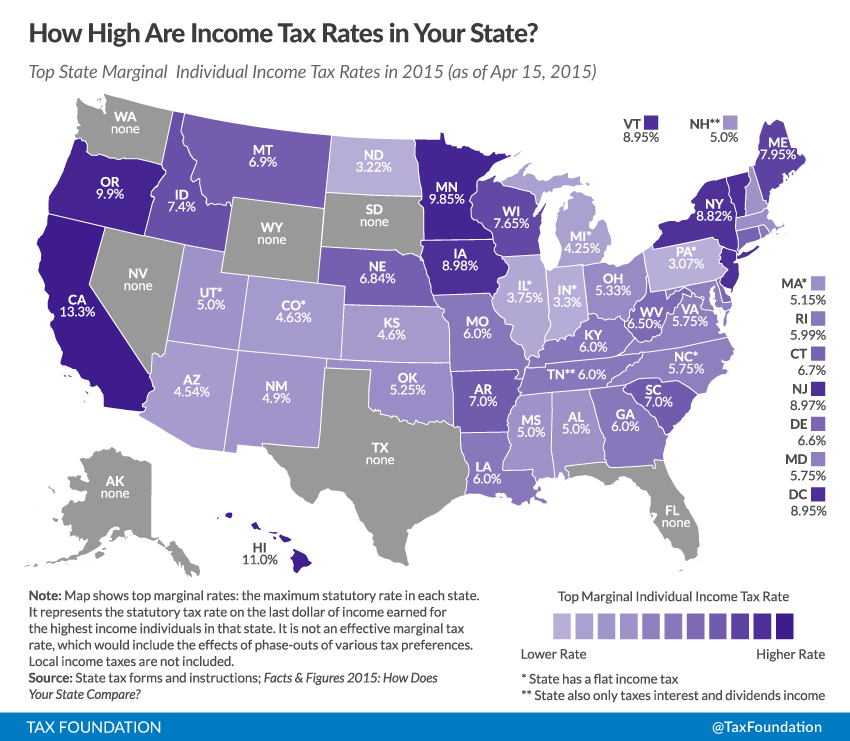

This rate is adjusted every two years. Colorado does not currently impose a property tax for state purposes see Colorado Dept. For income tax purposes if spouses file separate returns each spouse is taxed on 50 of the total community property income regardless of which spouse acquired the income.

In addition each spouse is taxed upon 100 of his or her separate property income. The qualified investment in used property is limited to 150000 per year and any amounts expensed under section 179 of b intent to establish domicile. Colorado is not a community property state in a divorce.

That means marital property isnt automatically assumed to be owned by both parties and therefore should be divided equally upon divorce. The marital estate should be divided equitably between the spouses upon dissolution of marriage legal separation or annulment. Income tax purposes and required to file annual federal partnership returns of income will not be subject to the Colorado withholding tax.

For income tax purposes if spouses file separate returns each spouse is taxed on 50 of the total community property income regardless of which spouse acquired the income. You Can Bet the Farm on It. Community property may also affect basis in property.

These states are Arizona California Idaho Louisiana. Its considered a separate property or equitable distribution state. Check your state law.

Nine states have community property laws that govern how married couples share ownership of their incomes and property. Thus as a general rule each spouse owns and is taxed upon the income that he or she earns. Is Colorado a Community Property State for Tax Purposes In some states the conjugal union ends when the spouses separate permanently even if there is no formal agreement.

However residential property is limited to an assessment rate of 21 of its actual value. The Colorado Department of Revenue Division of Taxation will hold a public rulemaking hearing on the following sales tax rule at 1000 AM. Its considered a separate property or equitable distribution state.

Apply community property laws to what is referred to as the marital estate The marital estate is a term used to describe all of the liabilities and assets tha If you are facing the possibility of divorce in Colorado you may feel overwhelmed by the emotional and financial challenges that come with such a. In the same way you are obligated by law to repay your spouses debt even if it does not carry your name. If you earn around 75000 the income is yours as much as it is your spouse.

Colorado is a state of marital property which means that matrimonial succession is divided equally versus equally. Only nine states in the US. That means that the assets and debts acquired during marriage ie.

Generally the state laws where you live govern whether you have community property and community income or separate property and separate income for federal tax purposes. This years reassessment which looked at property value increases between June 30 2018 and June 30 2020 resulted in an 113 increase in residential assessed values. 14 Is Colorado A Community Property State For Tax Purposes Pictures The intent to establish a domicile is essential in the determination of a persons domicile.

Local assessors reevaluate property values for tax purposes every other year. Colorado is a marital property state not community property. While fairly easy to determine your filing status when married either joint or separate tax rules get more complicated when you live in a community property state.

Common law is the dominant property system in the United States. Tweet this Exceptions to this are airlines pipelines railroads telephone companies and renewable energy companies all of which are centrally assessed by the Division Of Property Taxation. Is inheritance considered marital property in Colorado.

Instead when a couple divorces in Colorado the marital property is divided in an. Taxable property in Colorado is assessed at 29 of its actual value. Tax Issues for People Living in a Community Property State Couples living in a community property state own their marital properties income and assets jointly.

Unlike in community property states anything deemed to be marital property in Colorado is not assumed to be owned equally by both spouses and does not have to be divided equally in a divorce. Instead its divided equitably. State Taxes What is the state property tax rate.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With Highest And Lowest Sales Tax Rates

Don T Die In Nebraska How The County Inheritance Tax Works

How Do State And Local Sales Taxes Work Tax Policy Center

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

States Without Sales Tax Article

2022 Property Taxes By State Report Propertyshark

Ohio Sales Tax Small Business Guide Truic

Community Property States List Vs Common Law Taxes Definition

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Reports Show That The Irs Has Mistakenly Paid Out Billions In The Past Decade To Identity Thieves And People Who Fraudulently Claim Irs Taxes Tax Debt Tax Help

Property Taxes Property Tax Analysis Tax Foundation

Infographic Tax Day Income Tax State Tax Budgeting Money

State Taxation As It Applies To 1031 Exchanges

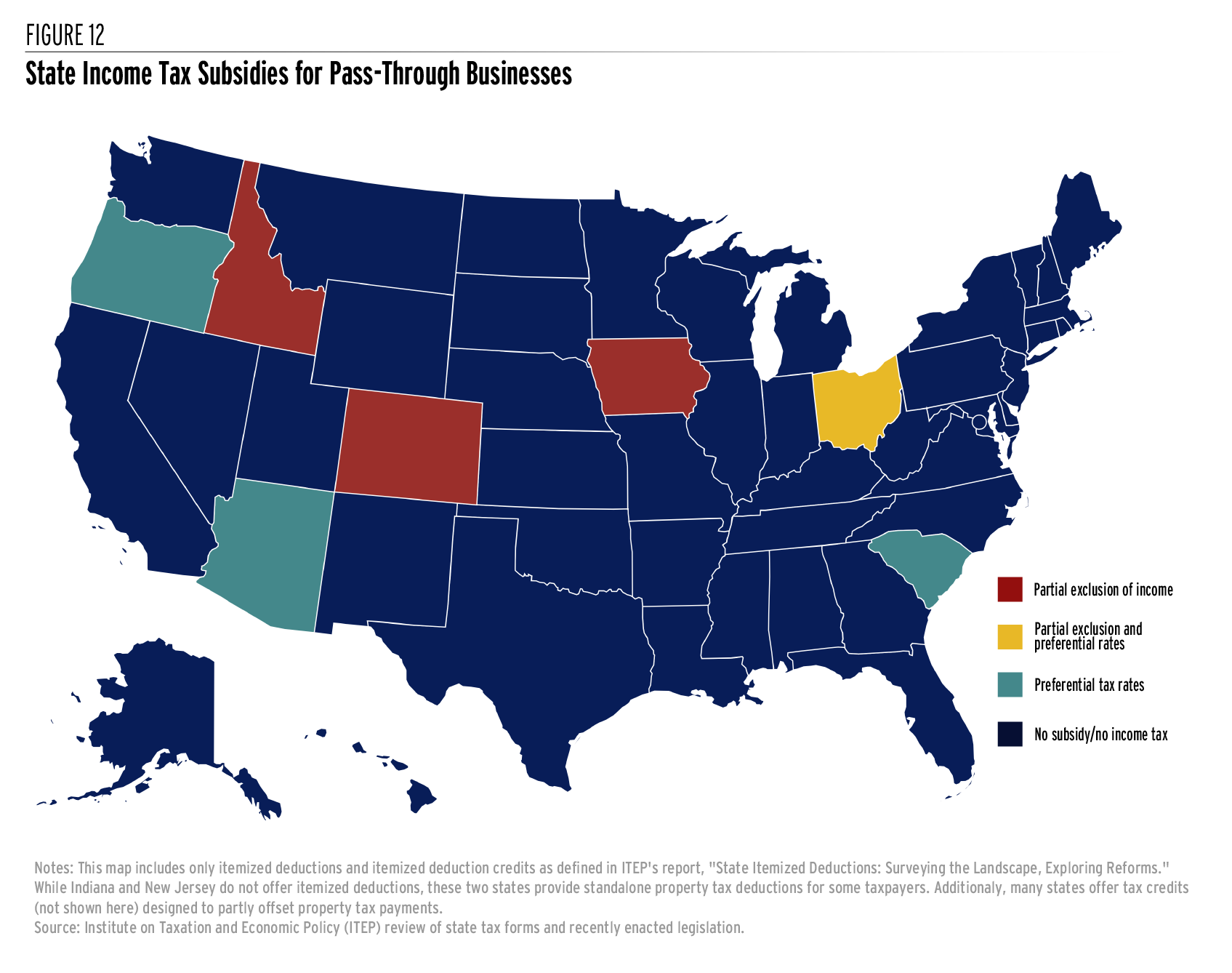

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)