nebraska car sales tax form

The Nebraska state sales and use tax rate is 55 055. Form 6ATV Nebraska Sales and Use Tax Statement for All-Terrain Vehicle ATV.

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

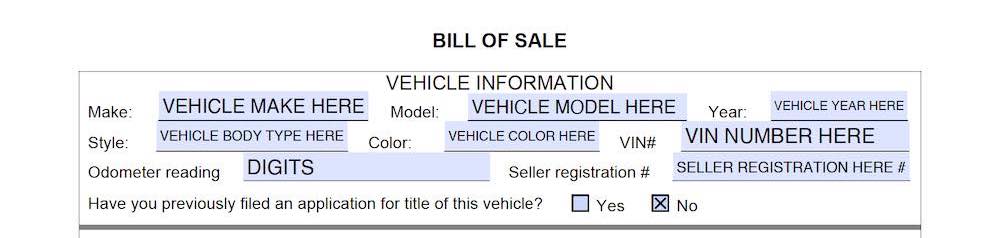

Utilize a check mark to indicate the choice where expected.

. Forms for county officials homestead exemption car lines air carriers public service entities and railroads. A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska. Double check all the fillable fields to ensure total precision. IRS 2290 Form for Heavy Highway Vehicle Use Tax.

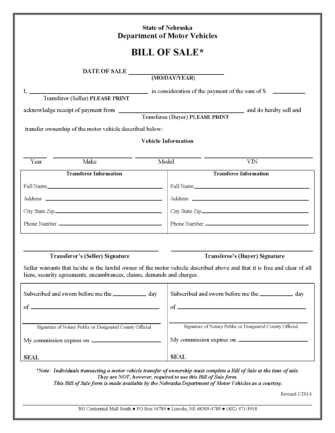

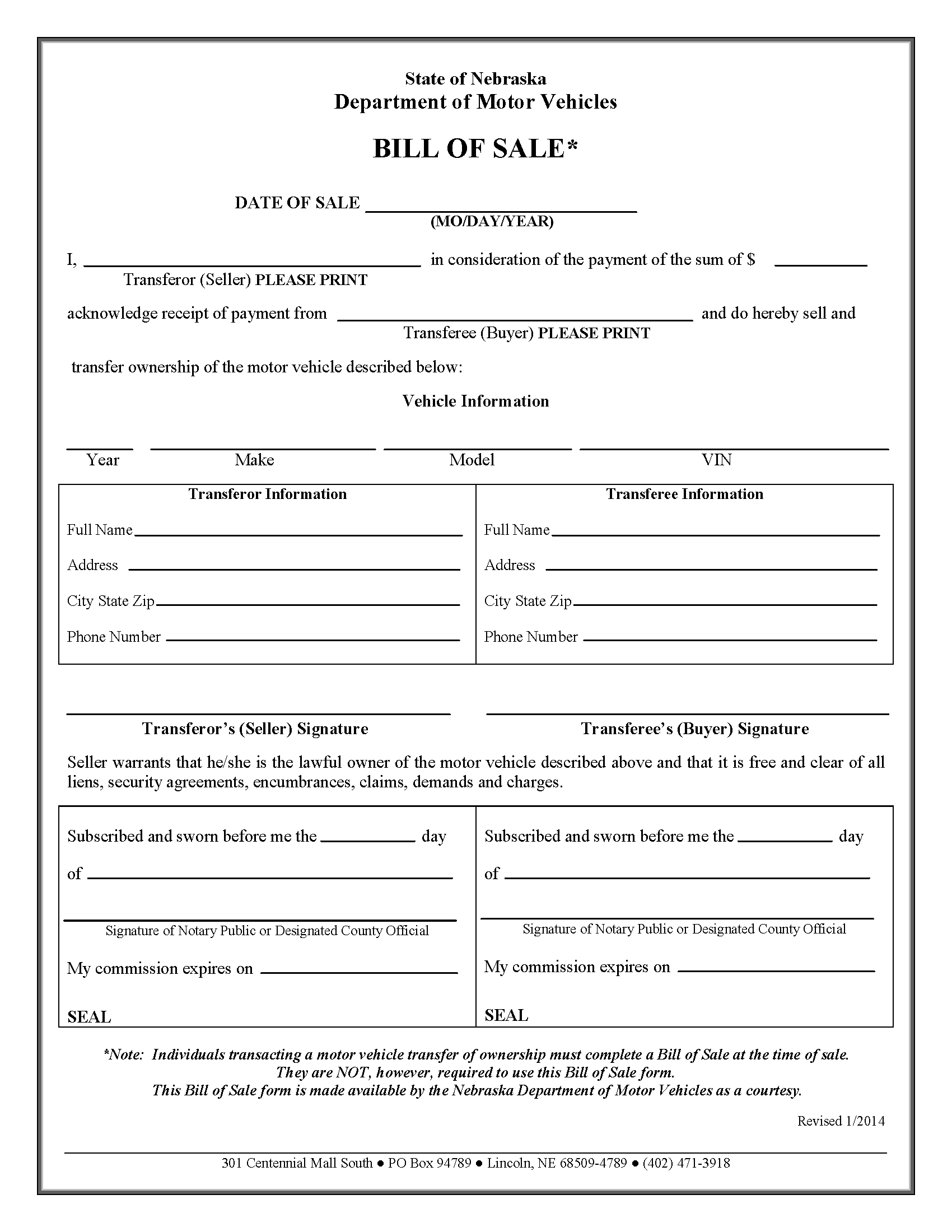

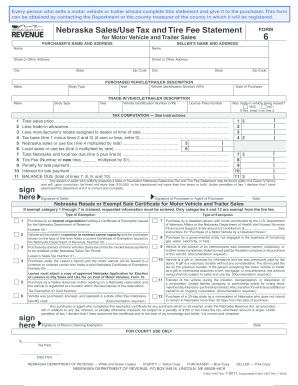

Or the date of. The Seller must also provide the buyer with a Bill of Sale or a completed Nebraska Department of Revenue Form 6 Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle And. State of Nebraska.

Enter the portion of the state sales tax reported on Form 10 line 3 that is from all leases or rentals of. You must complete an Application for Disabled Motor Vehicle Credit and submit it to the County Treasurer within sixty 60 days of the date the vehicle was disabled. Sales and Use Tax Regulation 1-02202 through 1-02204.

While some counties forgo additional costs most will charge a local tax on top of the state rate. Sales and Use Tax Applications and reporting forms for Nebraska sales and use tax. Motor Vehicle Tax is assessed on a vehicle at the time of initial registration and annually thereafter until the vehicle reaches 14 years of age or more.

In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. Sales Tax 60000 - 5000 - 2000. A completed Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6.

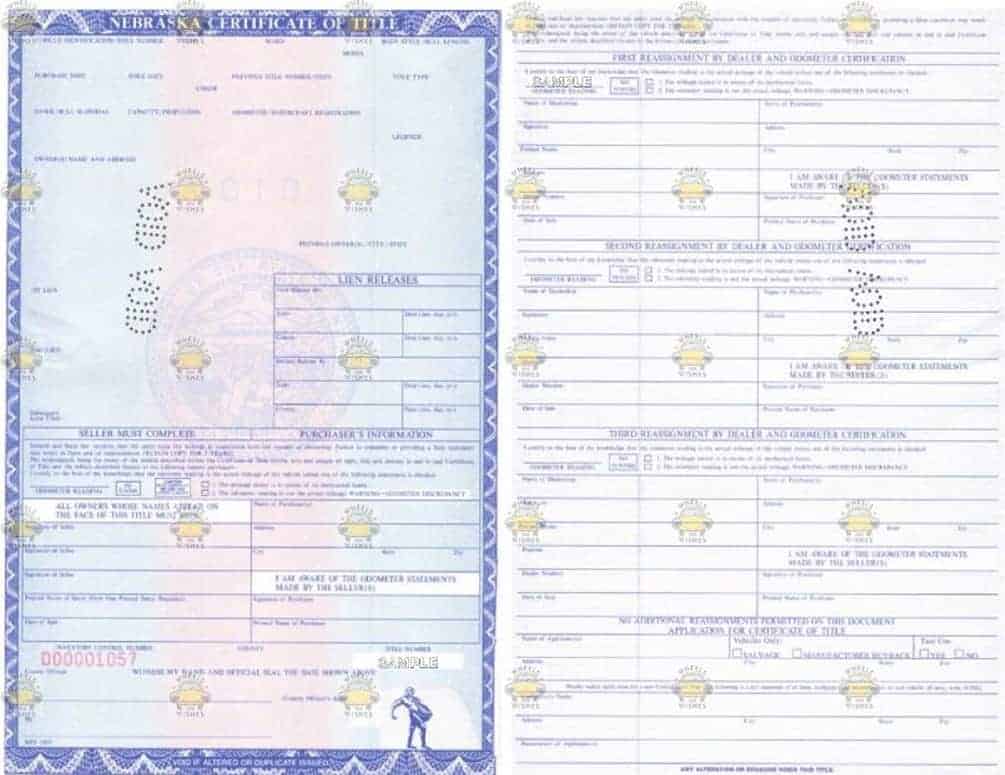

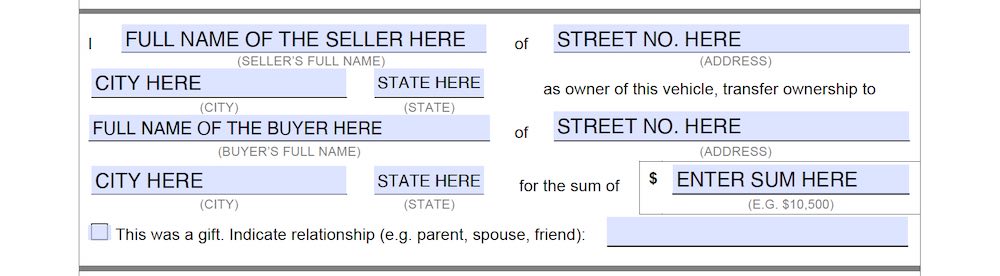

Online Registration Renewal To obtain information regarding specific registration. To sign over the Nebraska vehicle title you and the buyer. Transferring Your NE Title.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated 09082022. Enter your official identification and contact details. Nebraska car sales tax is 55 for any new or used car purchases.

It is based upon the MSRP. Sales and Use Tax Regulation 1-02202 through 1-02204. The date on the motor vehicle title.

The statewide sales tax for Nebraska is 55 for any new or used car purchases. When state and county rates are added. 1 automobiles trucks trailers semitrailers and truck tractors for periods of more.

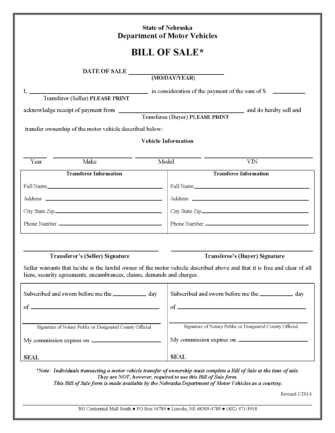

BILL OF SALE DATE OF SALE MODAYYEAR I in consideration of the payment of the sum of Transferor Seller PLEASE. IRS Form W-9 Request for Taxpayer Identification Number and Certification. The County Treasurer will.

Form 6XN Amended Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales. Nebraska Motor Vehicle Power of Attorney is required if a third party individual is registering the vehicle on behalf of the owner. Calculate Car Sales Tax in Nebraska Example.

Purchase of a 30-day plate by a. Department of Motor Vehicles. Newly purchased vehicles must be registered and sales tax paid within 30 days of the date of purchase.

No long forms no calling around and no hard work. The date of purchase is the earlier of two dates. From the date of purchase and pay the Nebraska and local sales and use tax and the tire fee.

Purchase of a 30-day plate by a. Proof that sales or excise tax was paid.

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Nebraska Vehicle Donation Title Questions

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

How To File And Pay Sales Tax In Nebraska Taxvalet

Nebraska Bill Of Sale Form Dmv Ne Information

Sales Taxes In The United States Wikipedia

Nebraska Auto Dealer Bond A Comprehensive Guide Bond Exchange

-%20Reverse.png)

Nebraska Vehicle Titles Kids Car Donations

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

Nebraska Auto Dealer Bond A Comprehensive Guide Bond Exchange

Form 10 Fillable Nebraska And Local Sales And Use Tax Return With Schedule I Mvl And Instructions 10 2011

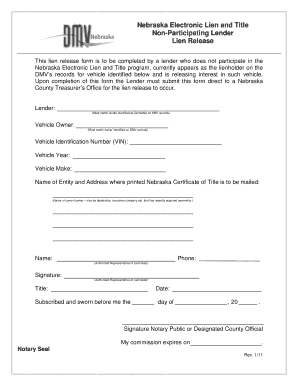

Nebraska Lien Release Fill Online Printable Fillable Blank Pdffiller

Form 44 Fillable Private Car Line Company Report And Schedule 2 2013

Nebraska Vehicle Sales Tax Form Fill Out And Sign Printable Pdf Template Signnow